Find the Best Mileage Tracker App for Accurate Mileage Log Management

Find the Best Mileage Tracker App for Accurate Mileage Log Management

Blog Article

Optimize Your Tax Reductions With a Simple and Effective Mileage Tracker

In the world of tax obligation deductions, tracking your mileage can be an often-overlooked yet crucial job for maximizing your financial advantages. A well-kept gas mileage log not only ensures conformity with IRS demands but likewise enhances your capacity to corroborate overhead. Choosing the right mileage monitoring device is necessary, as it can streamline the process and enhance precision. Many individuals stop working to totally utilize this chance, leading to prospective lost cost savings. Understanding the subtleties of reliable gas mileage monitoring may expose approaches that might substantially impact your tax circumstance.

Relevance of Gas Mileage Tracking

Tracking gas mileage is essential for any individual seeking to maximize their tax reductions. Exact mileage tracking not only makes sure conformity with IRS policies but additionally permits taxpayers to profit from deductions connected to business-related traveling. For independent people and local business owner, these deductions can significantly minimize gross income, thus reducing general tax responsibility.

Moreover, maintaining an in-depth record of mileage helps identify in between personal and business-related journeys, which is crucial for corroborating cases throughout tax audits. The IRS needs details paperwork, including the day, location, purpose, and miles driven for each journey. Without careful documents, taxpayers take the chance of shedding useful deductions or encountering charges.

Furthermore, efficient gas mileage tracking can highlight fads in travel expenses, assisting in much better monetary planning. By evaluating these patterns, individuals and services can identify possibilities to maximize traveling courses, reduce expenses, and boost functional performance.

Selecting the Right Mileage Tracker

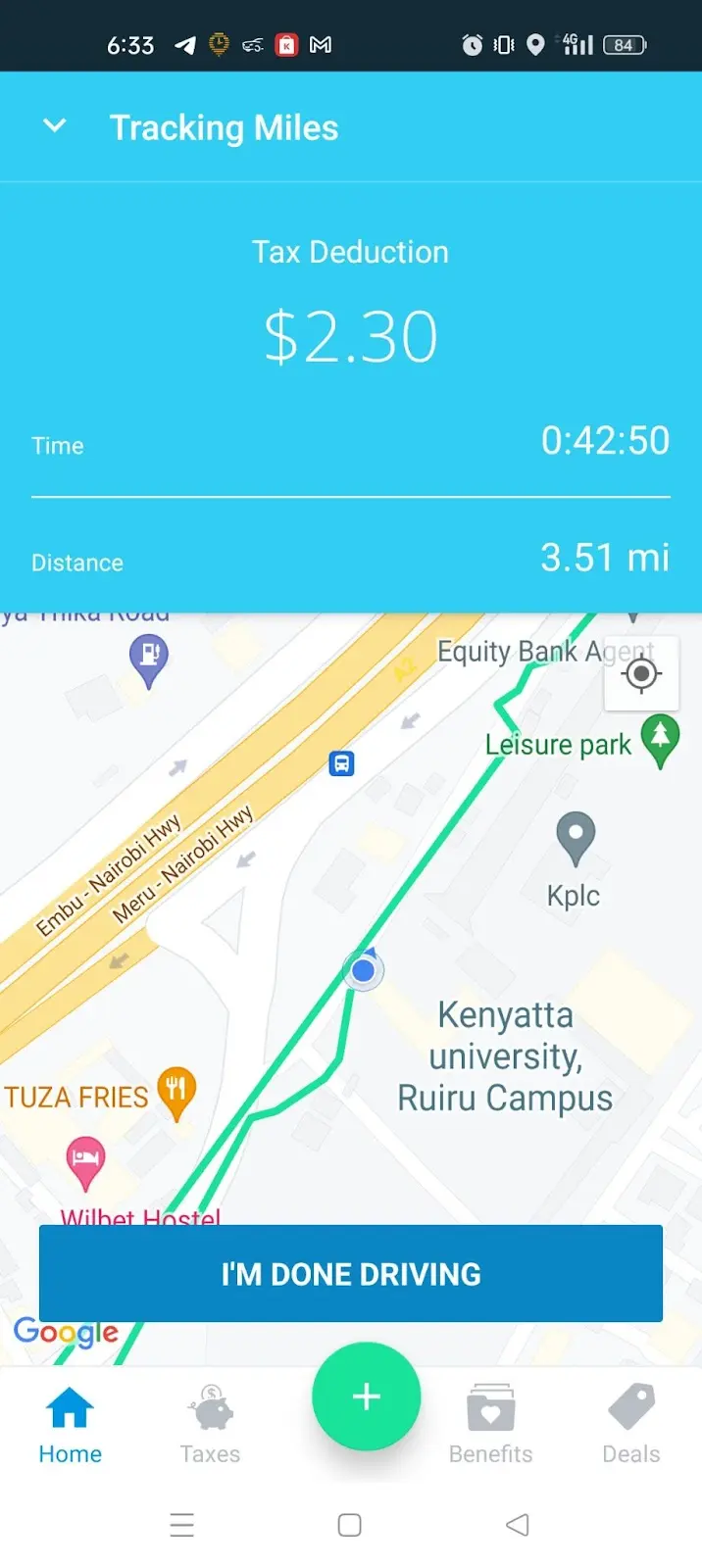

When choosing a mileage tracker, it is vital to consider various attributes and functionalities that straighten with your specific demands (best mileage tracker app). The very first facet to review is the method of tracking-- whether you like a mobile app, a GPS tool, or a hand-operated log. Mobile apps often offer comfort and real-time tracking, while GPS tools can supply more accuracy in range dimensions

Following, assess the assimilation capabilities of the tracker. A great mileage tracker must effortlessly integrate with accountancy software or tax prep work devices, enabling simple data transfer and reporting. Search for features such as automated monitoring, which lessens the need for hand-operated access, and categorization options to compare business and individual journeys.

Just How to Track Your Gas Mileage

Selecting a proper mileage tracker establishes the foundation for effective gas mileage administration. To accurately track your mileage, start by identifying the purpose of your journeys, whether they are for organization, philanthropic activities, or clinical reasons. This quality will certainly aid you categorize your trips and guarantee you capture all appropriate information.

Next, continually log your mileage. If using a mobile app, allow place services to automatically track your Learn More Here journeys. For hand-operated access, record the starting and finishing odometer readings, in addition to the day, purpose, and route of each journey. This level of information will certainly prove important throughout tax period.

It's also necessary to consistently assess your entrances for precision and completeness. Set a More about the author routine, such as regular or regular monthly, to consolidate your documents. This technique helps stop inconsistencies and ensures you do not ignore any type of deductible mileage.

Lastly, back up your records. Whether electronic or paper-based, keeping backups protects against information loss and promotes very easy access throughout tax prep work. By diligently tracking your gas mileage and keeping arranged documents, you will certainly lay the foundation for optimizing your possible tax obligation deductions.

Making The Most Of Deductions With Accurate Records

Exact record-keeping is critical for maximizing your tax deductions connected to gas mileage. When you preserve in-depth and precise documents of your business-related driving, you produce a robust structure for asserting reductions that might substantially reduce your gross income. best mileage tracker app. The IRS calls for that you record the day, location, function, and miles driven for each trip. Sufficient detail not just validates your cases but likewise provides protection in instance of an audit.

Utilizing a mileage tracker can streamline this procedure, enabling you to log your journeys effortlessly. Numerous apps automatically determine ranges and categorize trips, conserving you time and minimizing errors. Additionally, maintaining supporting documentation, such as receipts for relevant expenses, strengthens your case for Look At This deductions.

It's crucial to be constant in videotaping your gas mileage. Inevitably, accurate and orderly mileage documents are crucial to maximizing your reductions, guaranteeing you take complete benefit of the prospective tax obligation benefits readily available to you as a business chauffeur.

Common Mistakes to Stay Clear Of

Preserving careful documents is a substantial step toward taking full advantage of mileage reductions, but it's just as crucial to be mindful of usual errors that can weaken these initiatives. One common mistake is falling short to document all trips accurately. Also small business-related journeys can build up, so disregarding to tape them can result in substantial shed deductions.

An additional blunder is not differentiating between individual and organization gas mileage. Clear categorization is crucial; blending these two can cause audits and cause fines. In addition, some people fail to remember to keep sustaining documents, such as receipts for relevant costs, which can further validate claims.

Making use of a gas mileage tracker app ensures constant and reliable records. Familiarize yourself with the most recent policies relating to mileage reductions to stay clear of unintentional mistakes.

Conclusion

In conclusion, effective gas mileage monitoring is essential for maximizing tax deductions. Making use of a trustworthy mileage tracker streamlines the procedure of tape-recording business-related journeys, making sure precise documents.

Report this page